Delving into the World of Accounting: Understanding Key Activities

Accounting, a fundamental pillar of any business, is the language of money. It's the process of recording, classifying, summarizing, and analyzing financial transactions to make informed decisions. But within this vast field, various aspects work in harmony to paint a complete financial picture. So, let's dive into the world of accounting and explore the key activities that define different aspects of this critical function.

Financial Accounting: The Language of the Balance Sheet

Imagine your business as a story told through numbers. Financial accounting is the storyteller, capturing the financial health and performance of your business in a clear and concise manner. It focuses on creating financial statements, including the balance sheet, income statement, and statement of cash flows, used by external stakeholders like investors, creditors, and regulatory bodies. These statements provide a snapshot of the company's assets, liabilities, equity, revenues, expenses, and cash flows.

Key Activities Within Financial Accounting:

- Recording Transactions: This involves meticulously entering every financial transaction into the accounting system, ensuring accuracy and completeness.

- Preparing Financial Statements: This involves analyzing the recorded transactions and summarizing them into meaningful financial reports, adhering to generally accepted accounting principles (GAAP).

- Analyzing Financial Performance: Financial accountants use various tools and techniques to analyze the financial statements and identify trends, strengths, and weaknesses.

Think of financial accounting as the official report card of your business, providing a comprehensive overview of your financial performance and position.

Managerial Accounting: The Internal Compass

While financial accounting focuses on external reporting, managerial accounting is the internal compass that guides management decisions. It provides financial information tailored to internal users, such as managers, department heads, and decision-makers. This information helps them make strategic choices, monitor performance, and improve operational efficiency.

Key Activities Within Managerial Accounting:

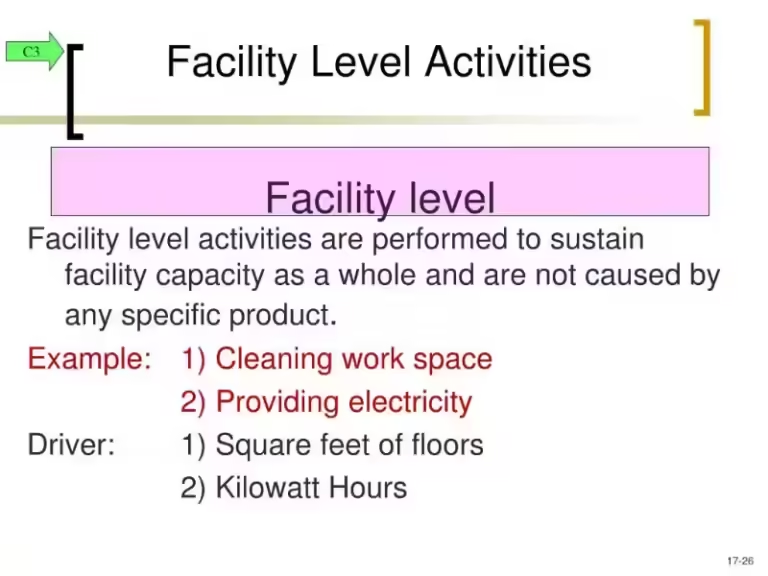

- Cost Accounting: This involves identifying, classifying, and analyzing the costs associated with producing goods or services. It helps managers make informed decisions about pricing, production, and resource allocation.

- Budgeting and Forecasting: Managerial accounting helps create detailed budgets and forecasts that guide operations, track progress, and identify potential financial challenges.

- Performance Measurement: Managerial accountants develop key performance indicators (KPIs) and metrics to track progress against goals and identify areas for improvement.

Think of managerial accounting as the internal roadmap that helps managers navigate the complex world of business operations and make informed decisions.

Tax Accounting: The Taxman’s Perspective

Every business has to face the taxman, and tax accounting ensures that your business complies with all applicable tax laws and regulations. This aspect of accounting involves preparing tax returns, planning tax strategies, and managing tax liabilities. It's a critical function, as non-compliance can lead to penalties and fines.

Key Activities Within Tax Accounting:

- Tax Planning: This involves developing strategies to minimize tax liabilities while maximizing profitability. It includes considering deductions, credits, and other tax incentives.

- Tax Compliance: This involves preparing and filing accurate tax returns, ensuring compliance with all federal, state, and local tax regulations.

- Tax Research: Tax accountants stay updated on the ever-changing tax laws and regulations to provide the best possible advice and ensure compliance.

Think of tax accounting as the legal team ensuring your business operates within the tax framework and avoids any unwanted financial repercussions.

Auditing: Ensuring Accuracy and Transparency

Auditing plays a crucial role in maintaining the credibility and integrity of financial reporting. Independent auditors examine the financial statements and internal controls of a company to provide assurance that they are accurate, reliable, and compliant with accounting standards. This process helps build trust among investors, creditors, and regulators.

Key Activities Within Auditing:

- Internal Audit: This involves evaluating the company's internal controls and processes to identify areas of risk and improve efficiency.

- External Audit: This involves an independent audit firm examining the financial statements and providing an opinion on their fairness and accuracy.

- Fraud Detection: Auditors are trained to identify potential instances of fraud and misconduct, ensuring that financial reporting is free from manipulation.

Think of auditing as the independent judge who ensures fair play and transparency in the financial world.

Conclusion: A Symphony of Accounting Activities

The different aspects of accounting work together like a symphony, each contributing to the overall financial health and success of an organization. Financial accounting provides the external story, managerial accounting guides internal decisions, tax accounting ensures compliance, and auditing guarantees accuracy and transparency. By understanding these key activities and how they interact, you can gain a deeper appreciation for the vital role that accounting plays in the business world.

Frequently Asked Questions

What aspect of accounting is associated with recording the purchase of office supplies?

Financial accounting

What aspect of accounting is associated with analyzing the profitability of a new product line?

Managerial accounting

What aspect of accounting is associated with preparing the company's annual financial statements?

Financial accounting

What aspect of accounting is associated with developing a budget for the upcoming year?

Managerial accounting

What aspect of accounting is associated with auditing the company's financial records?

Auditing

What aspect of accounting is associated with providing tax advice to clients?

Tax accounting

What aspect of accounting is associated with designing and implementing a new accounting system?

Management accounting

What aspect of accounting is associated with preparing a report on the company's cash flow?

Financial accounting

What aspect of accounting is associated with evaluating the company's investment opportunities?

Managerial accounting

What aspect of accounting is associated with preparing a statement of retained earnings?

Financial accounting