Corporate Ownership: Unlocking the Evidence

Understanding how an investor owns a corporation is crucial for investors, business owners, and anyone interested in the financial world. Corporate ownership is not a simple concept, and often multiple factors come into play. This article delves into the intricacies of corporate ownership, providing clear insights into how an investor's ownership is established and verified.

While there are various forms of ownership, the most common method is through the acquisition of shares. These shares represent a portion of the company's equity, giving the investor a claim on the company's assets and earnings. However, the specific rights and responsibilities associated with ownership can differ based on the type of shares held. For instance, common shares generally grant voting rights in company decisions, while preferred shares may offer a fixed dividend payment but typically lack voting rights.

Verifying Corporate Ownership: Beyond the Share Certificate

While a share certificate might seem like the cornerstone of ownership, it is only one piece of the puzzle. Today's world relies on digital records and databases to manage vast amounts of information efficiently. This digital evolution has also transformed how corporate ownership is tracked and verified.

Many countries, including the United States, employ centralized registries to maintain records of corporate ownership. These registries are often operated by government agencies or private organizations, providing a reliable source for verifying ownership information. The records in these registries are often updated in real-time, ensuring accuracy and transparency in the ownership chain.

Beyond the Official Records: Delving Deeper into Ownership

Beyond official registries, additional evidence can shed light on the complexities of corporate ownership. These factors can include:

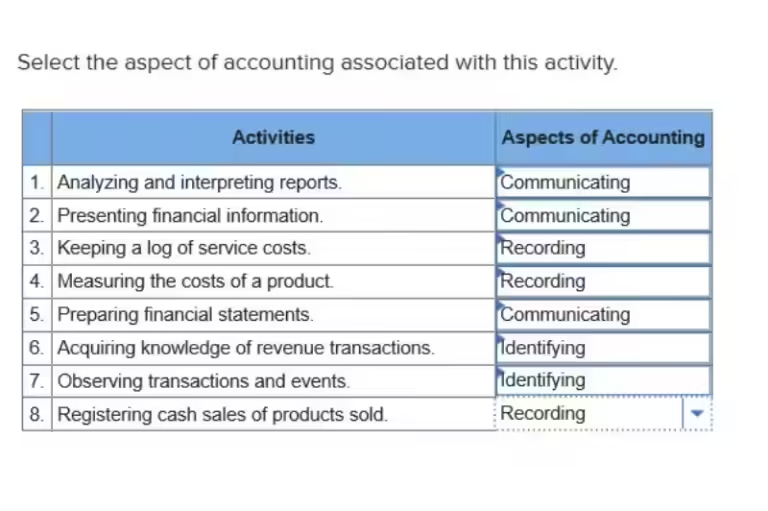

- Publicly Available Financial Statements: Companies that are publicly traded are required to file financial statements with regulatory bodies. These statements often include information about the company's share structure and the distribution of ownership among different investors.

- Share Transfer Agreements: When shares are transferred between investors, a formal agreement is typically executed. These agreements document the transfer of ownership and can be valuable evidence in determining the rightful owner of the shares.

- Proxy Statements: When a company holds shareholder meetings, it often sends out proxy materials to its shareholders. These materials include a list of the company's shareholders and their voting rights.

It is important to note that corporate ownership can be complex and can involve various legal entities and structures. Understanding these complexities is crucial for investors, especially when they are looking to invest in privately held companies.

The Importance of Transparency in Ownership

The transparency of corporate ownership is essential for several reasons. It fosters trust and confidence among stakeholders, including investors, creditors, and the public. Transparent ownership allows investors to make informed decisions about their investments, while creditors can assess the financial health of the company based on the strength of its ownership structure.

Furthermore, transparency in ownership helps to prevent fraud and abuse. When ownership is hidden or unclear, it creates opportunities for illegal activities such as money laundering and tax evasion. By requiring companies to publicly disclose their ownership structure, regulators can better monitor their activities and detect any irregularities.

The Challenges of Transparency

Despite the benefits of transparency, there are several challenges to achieving complete transparency in corporate ownership. These challenges include:

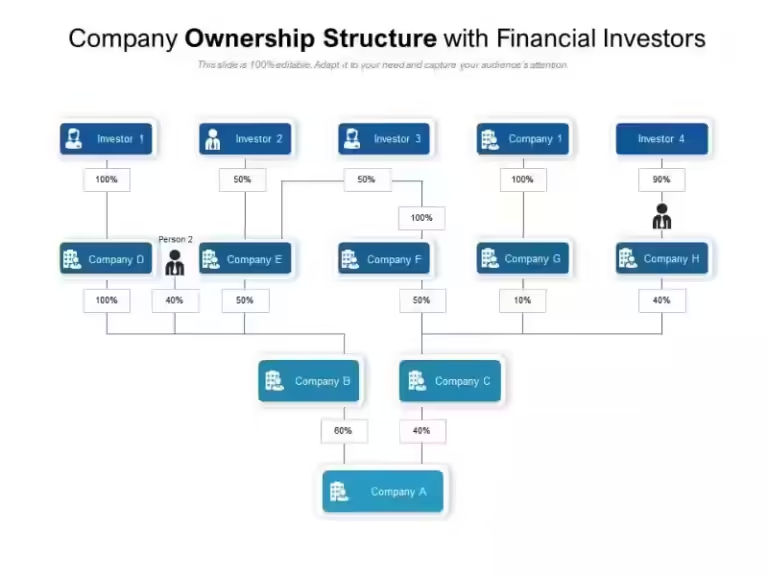

- Complexity of Ownership Structures: Corporate ownership structures can be intricate, involving layers of subsidiaries, holding companies, and trusts. Unraveling these structures can be challenging, even for experienced investors.

- Privacy Concerns: Some investors may be reluctant to disclose their ownership in a company for privacy reasons. This reluctance can hinder efforts to achieve complete transparency.

- Lack of Global Standards: There are currently no universally accepted standards for disclosing corporate ownership. This lack of standardization can make it difficult to compare ownership information across different jurisdictions.

As the global economy becomes increasingly interconnected, the need for greater transparency in corporate ownership is paramount. Regulators and policymakers are continuously working to address the challenges and promote greater transparency, ensuring a more robust and ethical financial system for the benefit of all stakeholders.

Frequently Asked Questions About Corporate Ownership

What evidence shows an investor owns a corporation?

This depends on the type of ownership. For direct ownership, shares of stock in the company's name are the primary evidence. For indirect ownership, such as through a trust or holding company, documentation of the ownership structure is necessary.