Navigating the Labyrinth of Investment: Understanding the "You Bought Prospectus Under Separate Cover" Clause

In the world of financial investments, it's crucial to be informed and discerning. One common phrase you might encounter is "You bought prospectus under separate cover." This phrase, while seemingly straightforward, can actually signify a complex web of regulatory requirements and investor responsibilities. Let's untangle this phrase and dive into its meaning, implications, and how it affects your investment decisions.

Understanding the Prospectus: Your Investment Guide

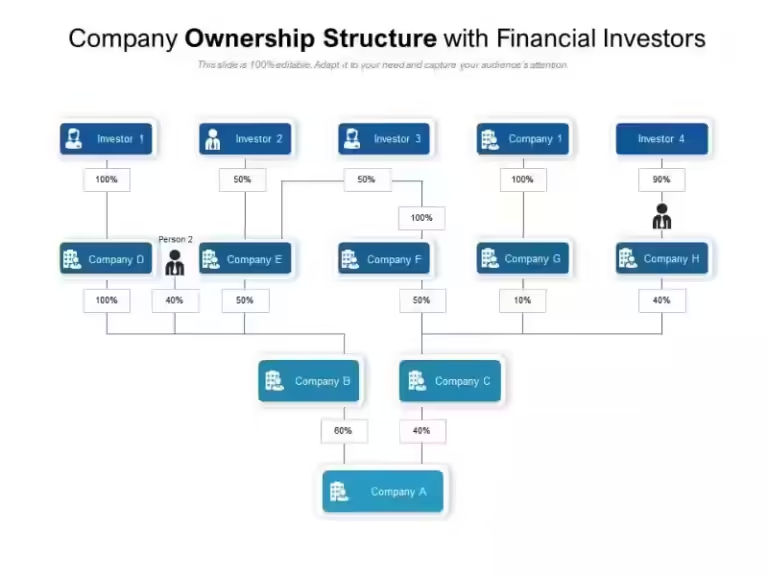

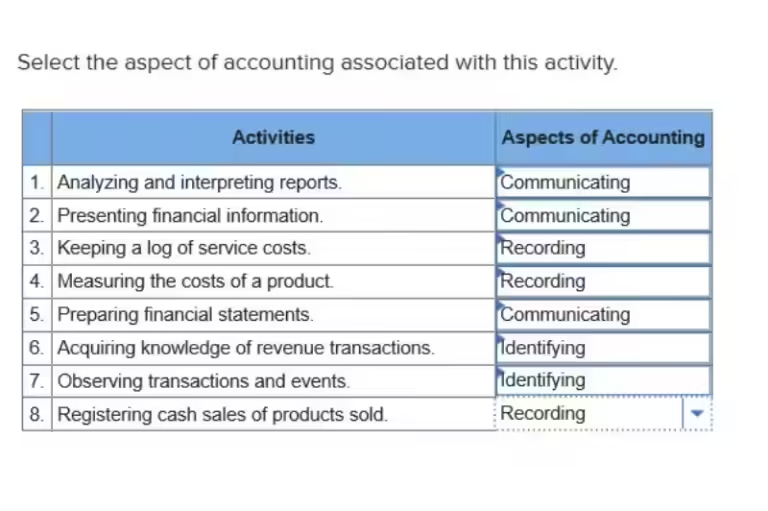

A prospectus is a comprehensive document that provides a detailed overview of a specific investment opportunity, usually a security like a stock or bond. It acts as a roadmap for investors, outlining the company's financial health, risks, and potential rewards. The prospectus should be a primary source of information before making any investment decisions.

Key Elements of a Prospectus:

- Company Information: This section details the company's history, business model, management team, and financial performance.

- Offering Details: This explains the specific investment being offered, the number of shares or bonds, the price, and the offering timeline.

- Risk Factors: A critical part of the prospectus, this section outlines potential risks associated with the investment, including market volatility, competition, and regulatory changes.

- Financial Statements: This includes audited financial information, allowing investors to assess the company's financial health and track its performance.

- Legal Disclaimers: These disclaimers outline the limitations of the prospectus and any potential conflicts of interest.

Imagine you're buying a new car. The prospectus acts like the car's manual. It tells you everything you need to know about the car's features, performance, and potential problems. You wouldn't buy a car without reading the manual, and similarly, you shouldn't invest in a security without carefully reviewing the prospectus.

“You Bought Prospectus Under Separate Cover”: What it Means

The phrase "You bought prospectus under separate cover" is primarily encountered in the context of initial public offerings (IPOs) or private placements. It signifies that the prospectus is not part of the initial offering document you might receive, such as a subscription agreement or a term sheet. Instead, it's sent to you separately, often via email or postal mail, after you've already expressed interest in the investment.

Why is the Prospectus Sent Separately?

- Regulatory Compliance: In many jurisdictions, regulators require that the prospectus be made available to investors independently of any marketing materials or sales pitches. This ensures that investors receive unbiased information about the investment.

- Efficiency: Separating the prospectus allows for concise and focused offering documents while providing investors with a comprehensive source of information. This can be more efficient and less burdensome than including the entire prospectus within a single document.

- Accessibility: By sending the prospectus separately, companies can ensure that it reaches investors in a timely and accessible manner. It can be easily downloaded or printed for review.

Think of it like receiving a restaurant menu separately from your reservation confirmation. The menu provides detailed information about the dishes, while the reservation confirmation confirms your table booking. The prospectus is the menu, and the offering document is the reservation confirmation.

The Importance of Reading the Prospectus

The "You bought prospectus under separate cover" clause signifies that the prospectus is crucial to your understanding of the investment. It's your responsibility to review the prospectus carefully before making any investment decisions.

Don't Just Skim - Dive Deep:

- Read the Risk Factors Section Thoroughly: This section highlights potential pitfalls and challenges that could affect the value of your investment. Understanding these risks is critical for making informed decisions.

- Compare the Company's Financial Performance: Examine the company's financial statements and compare them to industry benchmarks. This helps you assess the company's financial health and potential for future growth.

- Understand the Offering Terms: Pay close attention to the offering details, including the price, number of shares or bonds, and the offering timeline. This ensures you're comfortable with the investment terms.

Remember, investing involves risk. The prospectus should guide you through the intricacies of the investment and help you make informed decisions about your financial future.

Frequently Asked Questions

What does "you bought prospectus under separate cover" mean?

This phrase means that the prospectus, which is a document that provides detailed information about a company or investment, was sent to you separately from the other materials.